best books on avoiding taxes

In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in 2021. Best book on how to reduce or avoid taxes.

Download Lower Your Taxes Big Time Pdf Free Tax Reduction Economics Books Tax

Rating 102 Ratings.

. 2018-2019 101 Ways to Save Money on Your Tax Legally Amazon Kindle Edition. Best book on how to reduce or avoid taxes. 24 Thanksgiving Day flights tend to be cheap And coming home on these dates.

Below you will find six of the top tax and bookkeeping books for small business owners. 25 Black Friday Monday Nov. Theyre accessible to most people and the first thing.

Mark second book top 10 ways to avoid taxes was released in 2018 and teaches the strategies that the top 1 use to build wealth and legally avoid taxes. 10 Those 50 or. A Guide to Wealth Accumulation from the worlds largest community of readers.

Best book on avoiding taxes With Specifications. Certified Public Accountant this book is written for the small business owner or self-employed professional. Best book on how to reduce or avoid taxes.

And withdrawals for qualified health care needs are tax-free. Answered in 22 minutes by. Find the top 100 most popular items in amazon books best sellers.

The difference between a company structure and a trust. Its the best memoir Ive ever read Oprah Winfrey Will Smith isnt holding back in his. I read Constitutional Income Do You Have Any by Phil Hart and also Cracking the Code by Peter Hendrickson.

Best books on avoiding taxes. A Guide to Wealth Accumulation. Max out Retirement Accounts and Employee Benefits.

Top 10 Ways to Avoid Taxes. I also examined both sides of the controversy about Hendrickson as he has been called a Tax Protestor for his book which doesnt really make any protests but ra. Authored by a CPA.

Completely avoiding income tax seems impossible unless you want to just not make any money hmm but are there any good bookswebsitessources you guys are aware of on different ideas or investments and what not on how you can keep your tax burden down. 7 hours agoMonday Nov. Raftery Adrian Author English Publication Language 267 Pages - 05292018 Publication Date - Wiley Publisher.

Answer 1 of 4. If you saved 6750 a year for 20 years in an HSA earning 6 annually you would have 248000enough to cover average medical costs. 101 Ways To Save Money on Your Tax - Legally.

Ask Your Own Tax Question. How to Start Your Own Business Keep Your Books Pay Your Taxes and Stay Out of Trouble. Find books like Top 10 Ways to Avoid Taxes.

Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Books Amazon Ca

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez

The Best Witchy Books Wiccan Books Witchy Witchcraft For Beginners

100 Best Taxation Books Of All Time Bookauthority

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez

46 Best International Taxes Books Of All Time Bookauthority

Amazon Best Sellers Best Personal Taxes

Small Time Operator How To Start Your Own Business Keep Your Books Pay Your Taxes And Stay Out Of Trouble Edition 15 Paperback Walmart Com Starting Your Own Business Hiring

Where To Get Taxes Done Money Mindset Saving Money Personal Finance Books

Tax Free Wealth Build Massive Wealth By Lowering Taxes Book Review Passive Income M D

Managing Your Money All In One For Dummies For Dummies By Consumer Dummies Paperback

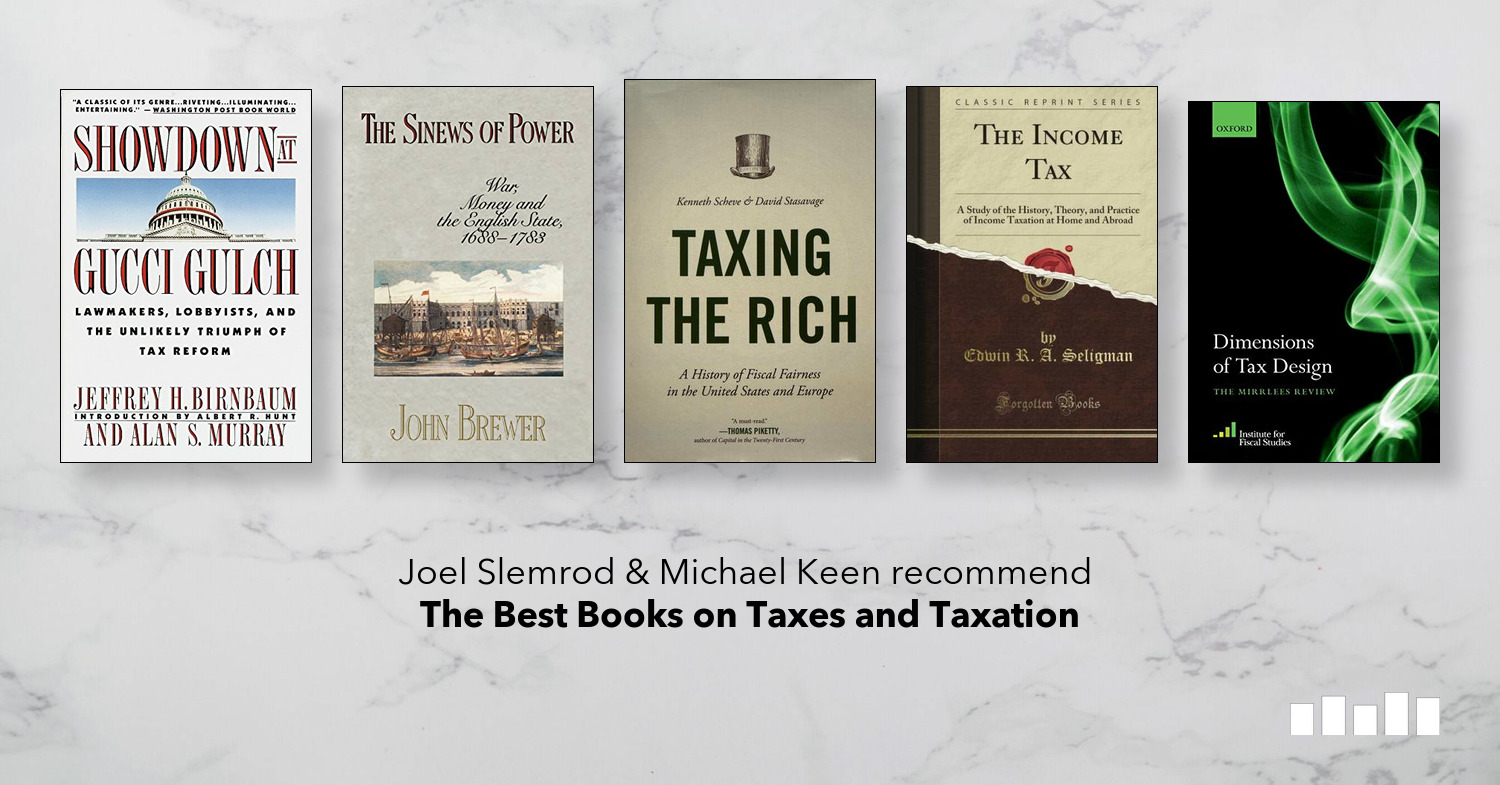

The Best Books On Tax Five Books Expert Recommendations

The Best Books On Tax Five Books Expert Recommendations

100 Best Taxation Books Of All Time Bookauthority

Tax Free Wealth Book Wealthability

The Best Books On Tax Five Books Expert Recommendations

The Best Books On Tax Five Books Expert Recommendations

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez